|

Worker apprehension over living standards and jobs worsened with the current economic crisis and the 4% unemployment rate. To improve these conditions, RENGO plans to request later in November, a 6-trillion-yen plus tax cut effective on January 1999, to the Ministries of Finance, Labor, and the Diet members of the political party (with the exception of the Communist Party) in charge of the Tax Commission and tax system problems. The contents of a concrete tax cut plan were confirmed in the 18th Central Executive Committee Meeting held on November 12, and current working measures to realize the plan were decided.

Current Measures for the Implementation of the 6 trillion-yen Tax Cut

- Lobby government, political parties, and Diet members, and create a policy towards the Diet.

In the latter part of November, RENGO will submit a formal request of the articles mentioned below, to the Ministries of Finance, Labor, and Diet members in charge of the Tax Commission and tax system from each party excluding the Communist Party. RENGO will conduct a follow-up report on the various responses to its request. And by way of response to the movements by the commission and others, RENGO will hold gatherings in the Diet, Diet liaison committees, and so forth.

- Response to the Commission

Responding to the government Tax Commission that on October 23 restarted its weekly deliberations, RENGO will endeavor to promote its ideas through its Commission members, namely RENGO Deputy President Enomoto and General Secretary Sasamori. And as it has in the past, the government Tax Commission plans to deliberate twice a week from December.

- Increase Public Awareness of RENGO's Requests

Explain the contents of the request mainly to RENGO members, but also to the media via our Internet site, inviting comments. In addition, holding study meetings for local RENGO is also under consideration.

- Possible Mass Movement

RENGO will consider using fliers and other methods to reach the nation as part of an effort to bring about its proposed "Emergency Economic Package" and "Tax Reforms."

Request for Current Tax Cuts and Fiscal Year 1999 Tax Reforms

| I. Tax Cuts as a Stimulus Measure |

With the national economy in negative growth due to sluggish consumption and shrinkage in plants and equipment investment, people increasingly feel more anxious about their standard of living. It is crucial to implement an urgent economic package including more than 6 trillion-yen (4 trillion-yen in income tax cuts and another 2 trillion-yen in institutional tax cuts) in tax cuts as soon as possible, to improve the economy and encourage consumer spending. The following measures should take effect in January 1999.

- Income Tax Cuts

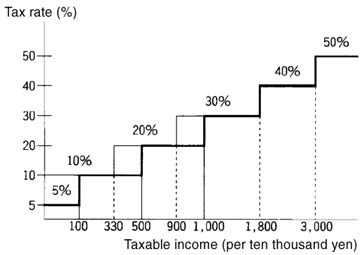

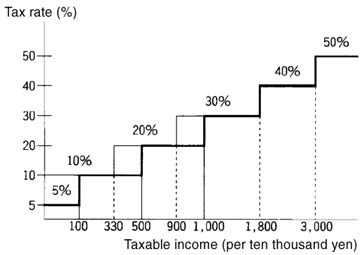

(1) To make tax cuts effective for low-income households, implementation of a minimum tax rate of 5% would change the tax rate scale to 5, 10, 20, 30, 40, and 50%. The 10 and 20% tax brackets should be expanded. Taxable income in the 5% bracket should be raised to one million-yen, the 10% bracket to 5 million-yen, and the 20% bracket to 10 million-yen.

(2) A flat tax is not acceptable in view of vertical tax burden equality and maintaining the redistributing function of taxation. A 50% maximum income tax rate is not seen as exorbitant when compared to foreign countries. When lowering the maximum tax rate, comprehensive taxation must be imposed and a taxpayer identification number system established to maintain transparency and fairness in the tax system.

(3) Maintain the current minimum tax level of 3,616,000 yen and deductions for income, dependents, and social security. Conduct a thorough re-evaluation of the dependents deduction system to reach a national consensus.

(4) Maintain resident tax rates at 5, 10, and 15%. Implement tax cuts by expanding each bracket and see that revenue source funding is the government's responsibility.

- A 4 trillion-yen Provision

To improve the economy for middle to low income households, those who will be most burdened by the special tax cuts in 1998, RENGO will introduce a provision of more than 2 trillion-yen in dependent allowances (10,000 yen for the 1st and 2nd child through the completion of compulsory education, and 20,000 yen from the 3rd child) and create a one-time provision of nearly 2 trillion-yen for seniors (an addition of 5,000 yen a month in benefits).

- Corporate Tax Cuts

To contribute to economic reform by generating new industry, a fair base tax should be achieved while at the same time reducing tax rates. In addition, tax-exemption of fringe benefits (extralegal welfare costs) should be maintained.

- Institutional Tax Cuts

- Housing Tax Cuts

Increase the amount and the period of deduction limits after home purchases. Create a system that allows taxpayers to select housing loan interest deductions, and create house rent deductions.

- Education Tax Cuts

Create a deduction for a certain school fees.

- Employment Development Deduction

Support employment development with tax measures such as excluding profits from disabled employment development grants, employment assistance grants for certain applicants, expand the tax system for senior employment, improve the working environment, and so forth.

- Tax system supporting worker development

Enact certain tax deductions for the cost of developing workers' abilities.

- Environmental Tax Breaks

Expand the tax system to promote investment by businesses in energy-saving programs. Enact new tax breaks for investing in reducing CO2 emission and re-cycling such items as pet bottles and electrical appliances.

- Automotive Tax Breaks

Exempt taxes on replacement car purchases past a given period of time, and create tax breaks for the purchases of clean fuel/low polluting cars.

- Tax Breaks for Information Investment, etc.

Create new tax breaks such as a special depreciation or deductions for information investment regarding "Millenium Bug" problems, etc. Also create a tax system which promotes investment in small to mid-sized businesses.

RENGO Proposed Income Tax Cut

|

RENGO's Suggested Income Tax Cut

A married couple, one employed, with two children

* Upper row: tax payment Lower row: the difference from the current system

Unit: 10,000 yen

** Notes: special dependent deduction for one child

| annual income |

current system |

RENGO plan |

20% cut plan |

year 1998 |

500

(taxable income 86) |

8.6

|

4.3

-4.3 |

6.9

-1.7 |

0.0

-9.5 |

| 600 |

15.6 |

10.6

-5.0 |

12.5

-3.1 |

6.1

-9.5 |

| 700 |

23.0 |

18.0

-5.0 |

18.4

-4.6 |

13.5

-9.5 |

| 800 |

31.0 |

26.0

-5.0 |

24.8

-6.2 |

21.5

-9.5 |

| 900 |

45.0 |

34.0

-11.0 |

36.0

-9.0 |

35.5

-9.5 |

1000

(taxable income 470) |

61.0 |

42.0

-19.0 |

48.8

-12.2 |

51.5

-9.5 |

|

|